|

|

|||||||||

|

||||||||||

|

|

|||||||||

Home Equity Loans

Bad Credit OK

Compare subprime equity loan programs and see new fixed rate home equity loans, credit lines and 2nd mortgages for people with bad credit scores. Nationwide Mortgages can direct you to leading subprime HELOC lenders that provide non-prime programs and solutions for you to find a home equity loan with bad credit in 2019. As you may already know, it can be difficult to find a lender that offers bad credit home equity loans to people with low fico scores. There is no cost and no application fees to shop lenders and rates on home equity loans and HELOC credit lines.

Shop Rates & Terms on Competitive Home Equity Loans & Bad Credit HELOCs from Trusted Lenders, Banks & Brokers Offering Low-Credit Loan Opportunities

Now you can meet the best lenders who specialize in subprime equity loans for people who have poor credit. In some cases, equity loans for homeowners with credit scores that range from 500-600 are allowed. Are you searching online for a home equity loan with a credit score under 600?

It's no secret that not that many lenders provide home equity loans for 580 credit scores or lower. We help people find brokers and banks that give access to programs for a home equity loan with imperfect credit to people with below average fico scores.

There is no cost or obligation to compare quotes from competitive lenders. The online process is quick and easy so get started now.

Now is a unique time to review lenders and shop for fixed rates on prime and subprime home equity loans, second mortgages and equity lines of credit. Many people would agree that bad credit home loans are easier to find in 2019, so take advantage of these flexible credit requirements and apply for an equity loan or home equity line of credit for bad credit today. How does a Home Equity Loan Work?

See New Cash Out Home Equity Loans for Bad Credit & Flexible Equity Lines of Credit with Low Interest Rates

For borrowers seeking more access to their equity, we offer no credit home loans for people with poor credit, and low fico scores. Home equity terms can vary significantly depending on credit sores, debt ratios and LTV's, so discuss your qualifications with a loan officer now.

Wouldn't it be nice if a mortgage company would extend a second chance to a homeowner seeking a home equity loan with poor credit scores? Our team will help you locate bad credit home equity loan lenders that set themselves apart from other banks because they continue to take risks by offering home loans for people with poor credit histories.

- Subprime Home Equity Loan Programs

- Hard Money Lending Opportunities

- Cash Back Lending from Trusted Banks

- Shop Subprime Brokers and Bad Credit Home Equity Lenders for HELOC and 2nd Loan Conversions

- FHA Loans with Cash Back to 85% CLTV

- Home Equity Line of Credit for Bad Credit

- Refinance HELOCs for a Better Fixed Rate

- New Home Loans for People with Bad Credit

Experts Guide to Home Equity Loans in 2019

As the US economy and housing market is heating up, property values are rising. So are interest rates, so if you have been thinking about tapping the equity in your home, 2019 may be the time! If you have been thinking about a home equity loan or home equity line of credit (HELOC), this article tells you everything you need to know to make your decision. We also have an important note at the end of this page describing major tax law changes for 2018 that affect the ability to tax deduct interest on home equity loans.

How to Calculate Loan to Value with a Home Equity Loan

If you have a $500,000 house and a mortgage balance of $300,000, the typical lender may allow you to access 85% of the equity in the property. So, 85% of $500,000 is $425,000. Minus what you owe - $300,000 � your maximum cash available for a HELOC or home equity loan in this case would be $125,000. Lending professionals refer to this calculation as, combined loan to value (CLTV) or total loan to value (TLTV). Loan to value is especially important when searching for a HELOC or home equity loan if your credit is not good.

Changes to Tax Laws Affect Home Equity Loans and Credit Lines in 2018

The Republican Congress passed in December 2017 a sweeping tax reform law that will have effects on home equity loans going forward. In 2017, all mortgage interest received preferential treatment from the IRS. Americans were able to tax deduct mortgage interest on homes of up to $1 million. The average tax payer was able to save $2,000 per year on their taxes under the old rules.

Under the new law, the deduction is going to be limited to $750,000 on first mortgages. But that is not all. The new tax law will eliminate the ability of homeowners to use their home equity loans and credit lines to get financing that is tax deductible for non-home acquisition purposes. In 2018, interest that is paid on home equity loans that is not thought to be for home acquisition will no longer be tax deductible. Under the old law, homeowners could deduct $100,000 of home equity interest.

In past years, Americans were using their property's equity to get low, tax deductible interest rates on major purchases, even if the purchase had nothing to do with housing. But under the new law, you no longer can use a home equity loan as a cheap way to finance things other than homes. See the 2018 IRS rules for mortgage interest deductions.

Need Help Finding Private and Subprime Lenders & Banks Offering HELOCs and Home Equity Loans for Bad Credit?

Shop Online and you will enjoy the friendly loan officers that average almost 12 years of experience. Let's be honest, home equity loans for people with credit problems is a niche market, so who you work with to get approved is paramount.

Five Important Equity Loan Tips to Consider Before Signing Docs |

1. Make sure the rate on your 1st mortgage is at or below the current market averages. Home equity rates are often a little bit higher than rates on 1st liens. If the interest rate on your current lien is higher than the market average, it may be prudent to refinance your existing mortgage. If your present rate happens to be an adjustable one then it is also wise to consider a loan with a fixed rate, term and monthly payment. 2. Prioritize your goals before loan shopping. Itemize how much money you actually need for home repairs, bill consolidation or investments. It is important to borrow enough money, but it is also wise not to pay interest on money you do not really need. In cases in which you are remodeling a house or starting a new business then an equity line of credit may be the best option because of the flexibility it encourages. The Consumer Financial Protection Bureau does a good job outlining the pros and cons of credit lines vs equity loans.

3. Know your credit scores. This will save you time and help you portray a savvier image when speaking to finance professionals. This may help you steer clear of lenders that may not extend credit or loans with your fico score range. Not all lenders approve home equity loans for people with bad credit scores, so it makes sense to find companies that actually meet your needs and credentials. Again, most "big banks" and companies advertising on TV do not offer risky loans to people with credit problems and lack of equity. While no company can extend a guaranteed home equity loan with poor credit online, it helps to know your 3 scores when you talk to a lender, bank or broker. If you need a credit line or home equity loan or line of credit with a credit score under 600, then you better get organized. You will need to have those "letters of explanation" ready for the underwriters because they will want a detailed account as to why you had late payments, etc. 4. Find lenders that finance the loan you seek. When shopping for a home equity mortgage verify with the companies you are shopping that offer the type of programs you are seeking. Talk to banks, credit unions and finance sources that have a history taking risks with borrowers that might have a checkered past with credit. Without spending any money out of your pocket, we can help you find bad credit home equity loan lenders to see if they can meet your needs. 5. Compare quotes and disclosures carefully. It is critical that you compare "apples" to "apples", when shopping for 2nd mortgages. Compare rates, fees, terms and lending costs in a side by side analysis. Once you narrow it down then you compare reputation and customer service so that you can make a prudent decision on the best home equity loan with bad credit for your situation. Avoid talking with companies that want to charge you up-front for simply completing the home equity loan application. |

The Pros and Cons of Taking Out a Home Equity Loan with Bad Credit

A home equity loan is an excellent way for a home owner to take cash out of their home to buy what they need. Whether you want to pay off debt, fund college tuition or invest in real estate, a home equity loan can get you the low interest cash you need!

But...what if you have low credit scores? Is it still possible to get a home equity loan if your credit score is not up to par? Generally, yes, it is possible. Mortgage lenders know that people are most likely to pay their mortgage payment first and foremost. After all, if you do not pay your mortgage, you lose your home in foreclosure. Your home is security or collateral for the loan, so it is likely that the bank will get their money.

On the down side, borrowers with poor credit will typically see less favorable interest rates on home equity loans. You could pay more in points and in interest on your home equity loan if you have damaged credit.

Also, you may not be able to borrow as much money. Lenders will usually allow you to borrow up to 80% of the equity in the home. The greater your amount of equity, the better chances your application must be approved. So, if you have more equity and bad credit, you are more likely to get a green light on your application. If you continue to be denied on a home equity loan application, consider a cash out refinance for poor credit, as some lenders are more comfortable taking a risk on 1st mortgage liens.

Poor Credit Home Equity Loans and Home Equity Lines of Credit with Low Credit Scores

Whatever your credit score, you have two choices for a second mortgage: a home equity loan or a HELOC. A home equity loan is a lump sum payment of part of your equity. You repay it in fixed monthly payments with a fixed interest rate over 20 or 30 years. This type of second mortgage has the advantage of being a fixed rate payment. You know exactly what to expect month in and month out.

Your other option is a HELOC, which is a line of credit based upon the amount of equity in the property. The interest rate on a poor credit HELOC is usually lower but it is variable. Payments can go up, and you also will have to start paying back principal after the 10-year draw period ends. This means that you are going to be facing higher payments down the road. This is fine, but you should plan ahead.

If you want to get a home equity loan or HELOC with bad credit, it is possible. But you should follow these easy steps:

- Review your credit report: Check your credit report regularly to see what your score is and that there are no inaccuracies that are dropping your score. It is not unusual for there to be misreported items on a credit report that affect your score. Ask your lending representative if a "Rapid Re-score" would increase your score high enough so that you would have to apply for a home equity loan with poor credit.

- Gather your financial documents: Lenders will want to see that you have the income to support the higher payments with a home equity loan. This is especially critical if you have below-average credit scores.

- Talk to a mortgage broker or home equity lender: It is always good to shop around, especially with poor credit. An advantage of a mortgage broker is he or she can access dozens and even hundreds of lending programs from different lenders. Some lenders have better bad credit equity home loan programs than others. Most private lending companies will direct you towards a first lien refinance, because the default rate is so much higher on home equity loans for people with imperfect credit.

- Think about rates carefully. You may want to just run to your current lender to get a home equity loan. But it does not follow necessarily that being a current client will get you the lowest interest rate. The best rates always go to those with the best credit. Always shop around at different mortgage brokers, banks and credit unions, because even with bad credit home loan rates can vary dramatically.

- Consider a co-signer. If your credit is not good, you can get a better rate by having a co-signer with good credit. Be sure that your co-signer has very good credit and a good job.

- Improve your credit. It is possible to get a home equity loan with poor credit. You will pay a higher rate and have a lower borrowing limit most likely. If you are having trouble getting approved for the terms you want, ask your lender what they need to see from you to get you the best terms. If you make sure your payments are on time and you have low balances on your credit cards, you will have a better chance of getting a better rate.

Should You Get a Home Equity Loan with Bad Credit?

Whether it is worth getting a bad credit home equity loan or not depends upon many factors. Here are the pros and cons:

Pros:

- You will get cash that you need for a home improvement or paying off debt. This can put you in a better financial situation. Home improvements done right can lead to a higher home value.

- You can write off the interest on your taxes usually. With a higher rate, you will be able to write more off.

- Even with a higher rate with inferior credit, you will still be able to get a lower rate than a credit card or a personal loan.

- More mortgage debt with on time payments typically raises your credit score.

Cons:

- You pay more in interest, which greatly increases your interest payments over the years.

- Your monthly payment will be higher.

- You are putting your home at risk. If you do not pay the loan, you lose your home.

- Paying off credit cards with home equity credit loan can lead to a death spiral of debt if you are not disciplined.

- Some home improvements do not result in higher home values, so remodel carefully.

Home owners with bad credit have more options for a home equity loan or HELOC now than a few years ago. If you follow the above advice, you should be able to get the cash you need.

References: investopedia.com

6 Best Uses for a HELOC Loan with Bad Credit1. Pay for Home Renovations with a Low Interest Home Equity Line of Credit One of the best reasons to take out a HELOC is to do home repairs and renovations. If you are able to do reasonable repairs that enhance the value of the home, you will be paying yourself back in large part when you sell your home. Also, you may increase the value of the house so that you can take more cash out if you wish. Typically, your credit score will dictate which HELOC loan program you actually qualify for and how much money you will have access to, but there are several home equity loans for poor credit that are worth learning more about. 2. Pull Cash Out of the Home Equity Line to Invest in Real Estate If you can qualify for a HELOC with a competitive rate and invest in real estate investments that pay at least 10%, you will end up making good money on your HELOC loan. You need to be sure that you are borrowing money for real estate investments that are truly going to pay you back. 3. Some HELOC Loans Have No Closing Costs Some banks, such as Chase, offer a HELOC loan to some borrowers without closing costs. If you can access your cash without paying any closing costs, this is hard to pass up. Of course, qualifying for a home equity line of credit with bad credit may be more difficult, but there are more lenders and brokers taking risks on subordinate fianc� products than any time in the last decade. 4. Consolidating Consumer Debt If you have credit card debt that you are paying 15% or more interest on, you might want to consider paying off those loans with a HELOC. In many instances, you will pay much less in interest. Thousands of homeowners in the US are refinancing unsecure loans and consolidating debt with subprime and bad credit HELOC loan programs from trusted bad credit home equity loan lenders. 5. Lower Closing Costs than a First Mortgage Another option to get cash is to do a cash out refinance of your first mortgage. Doing a first mortgage costs you several percentage points in closing costs, but a HELOC is usually quite a bit less. The paper work to do a HELOC is less onerous, so there are fewer fees. 6. Paying Your HELOC May Increase Your FICO Score The credit bureaus love to see installment loans paid on time. A home equity line of credit with bad credit and a first mortgage are forms of installment loans. If you take out a poor credit HELOC loan and make the payments on time, it will raise your credit score substantially. Having a higher credit score can make your life much easier when it comes to getting other types of credit, including credit cards and car loans. |

| Find Rewards When You Go Green at Home | |

Benefits for Making Your Home Solar Friendly in CA - Yes, the State of California continues to extend financial incentives for homeowners to upgrade their energy to solar. The FHA 203K loan rewards borrowers looking to finance energy efficiency appliances and more. Get Paid by HUD to Reduce Utility Costs at Home - The Department of Housing and Urban Development announced new programs for energy efficiencies. Ask about the Pace finance program for solar energy. Guide to Going Green at Home |

|

| Read and Review New Bad Credit Home Loan Programs |

| Stated Income - Home Equity Mortgage |

100% CLTV- Not Available |

| Reduced Documentation – House Loans |

| 100% CLTV- down-payment assistance - See Lenders for eligibility 96.5% CLTV- See FHA loan limits that vary by region Learn more details when shopping Nationwide lenders |

| Full Documentation - Rate and Term Equity Loan Refinancing (W2's, Paystubs etc.) |

100% CLTV- maximum loan amount-is $300,000 - Not Available |

| Second Home - Home Equity Credit Line (HELOC) |

100% CLTV- Not Available |

| Non-Owner Occupied - 2nd Mortgage |

90% CLTV- Not Available |

| Past Credit Problems? Learn These Credit Tips When Considering a New Home Loan |

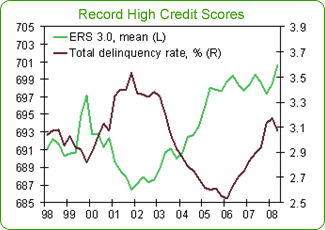

Too often we talk to people that say they want to reap the benefits of low interest rates but out of fear of rejection, they do not apply because at one time they were turned down. Do not let past credit blunders prevent you from applying for an equity home loan. Nor should you let income documentation hinder you from setting up a credit line or converting debt into a more responsible fixed interest rate loan. Most of the stated income programs have been placed on hold. Millions of homeowners need limited or reduced documentation loans because of their employment and the current economic conditions. The credit standards have been eased on subprime home equity loans, HELOCs and cash-back refinance programs.  Refinancing or adding an equity credit loan can help your credit score rebound dramatically. Quite often it also increases your fico scores with a good payment history. Many homeowners are not aware that there are several proven measures a person can take to improve their credit ratings as reported by EquiFax, Experian and Tran Union. It is very It makes sense to find out if you are eligible to get a home loan for people with damaged credit scores.

|

| Should I Refinance to Get More Money or Take Out a Home Equity Loan? |

Many homeowners get confused in regard to refinancing their existing lien or taking out a second mortgage, also known as a home equity loan. If you have a low interest rate that is at or below market availability it usually makes sense to leave your current mortgage unchanged and opt for a subordinate lien like an equity loan.

Do the Math - Simply take your existing 1st payment plus the 2nd payment and see how that total compares to refinancing your current loan for more cash. Make sure you are comparing, "apples to apples", in that you are considering the total amounts borrowed including fees, pre-payment penalties etc. Either way you will be borrowing more money because in a sense you are using your equity or leveraging your home's value. Compare Offers on Your Terms; No Cost Home Equity Quotes from Multiple Lenders*home equity loan approvals are subject to application submission and to mortgage lender approval based on the following: verification of income, employment, assets and other information like obtaining an acceptable property. Not everyone will qualify for poor credit home loan programs. Please note that "equity loans" are liens held in second position on the property's title, so it may deem a higher risk with underwriters. |

Nationwide's Commitment for Superior Lending |

|

Many brokers and lenders may be offering equity loans and second mortgages that seem too good to be true... You know how the saying goes...The offers are probably too good to be true. A respectable indication of this usually happens when the representative from that bank promises to call you back, but neglects to answer his/her phone, return your messages or send you the finance disclosures that are required by law. At first you are surprised they do not return your calls, because you are ready to do business and they seemed so nice when they quoted you such amazing rates that were so much lower than the competition. At Nationwide, we go to great lengths to match you up with real companies that deliver what they say they can do. It Makes Sense to Work with Banks, Brokers and Lenders that You Can Trust Be careful comparing rates on home equity loans, because many companies are making unbelievable offers to people with considerably high credit scores. Avoid spending time with people who quote you terms without analyzing your credit, and debt ratios. In most cases, bad credit equity loan rates are typically a few points higher than prime rates. Of course, understanding the estimated value of your house is imperative for getting a real quote. This year you can still locate a few lenders that offer equity loans for people with bad credit, so do not assume that there aren't cash out programs or a debt consolidation home equity loan for you because you have a low fico score. In most instances, you will need more equity if you do not have a good credit history. |

|

Learn How to Apply for a Home Equity Loan

Compare and Review Revolving Home Equity Lines or Fixed Rate Equity Loans for People with Bad Credit - Interest Only Payment Options |

Get Pre-Qualified for a Low Rate Home Equity Line of Credit Key Home Equity Factors - 80- 100% Equity Loans |

|

Are You Considering Equity Loans to Settle Debt?

Should I settle my tax debt with the IRS or pay off my tax liens with an equity loan?

It's no secret that the Federal Government has been issuing an increase in "offers in compromise" in the last few years. However typically if you have the ability to get cash from an equity loan then the IRS would have you pursue that option first. The "fresh start" program enables taxpayers the ability to start over.

Keep in mind that an offer in compromise can take years and a bad credit equity loan may provide you the ability to pay off the IRS and consolidate high interest debts a lot quicker.

If you already have tax liens you may need a hard money mortgage or a home equity loan for bad credit refinancing.

We suggest discussing your eligibility with a tax attorney before assuming anything. You can read more about the Fresh Start Article from the San Francisco Chronicle

Find out if you are eligible for financing that allows negative equity. This high-risk program typically requires a better credit profile and most lenders will charge a higher interest rate to off-set the risk inherited. Get matched with high risks lenders offering home equity loans for people with low credit scores.

Bad Credit Loans for Debt Consolidation and More

It may make sense to leverage your debt into a tax-deductible simple interest loan. Not always, but in most cases qualified homeowners can reduce their interest paid and lower their monthly obligations at the same time. Find out if these secure loans will provide relief for your situation.

If you are happy with your existing loan it makes sense to consider an additional lien versus refinancing. When the Fed hikes rates, these equity loan programs soar in popularity.

Home Equity Loan Disclosures: The 3.5% rate mentioned on this page was for a 250,000 at 3.5% is $1,122.61. This example of this rate would be with $1,195 paid at closing. The APR on this equity loan is 3.67%. (8/1/2013) Please be aware that loan to value below 90%, debt to income ratios below 50% and acceptable income documentation is required for this example. Taxes and insurance are not required on home equity lines of credit either.

|

|

|

|

Home | About Us | Warranties and Terms | Articles By clicking "Complete My Request" I am consenting to have my info shared with up to four lenders, brokers, CreditOptions, New American Funding, Global Equity Finance, Loan Depot and other business affiliates and for them to contact you (including through automated means; e.g. autodialing, text and pre-recorded messaging) via telephone, mobile device and/or email, even if your telephone number is currently listed on any state, federal or corporate Do Not Call list. Consent is not required to purchase goods or services from lenders that contact me. Nationwide offers no cost home loan quotes for people seeking refinancing, home equity, purchase mortgages in the United States. Our affiliated lenders will review the credentials of applicants with all types of credit on FHA, VA, Fannie Mae, Freddie Mac and jumbo products. Not everyone will be approved nor can loans be guaranteed online. This website has no affiliation with any government entities. Filling out this form puts you under no obligations. Mortgage rates and home loan programs are subject to change without notice. There is no application fee from participating lenders or banks. This is not an advertisement for credit. This is not a commitment to lend. Certain state restrictions and requirements may apply. ©2000-2019 NationwideMortgages.net - All rights reserved. Nationwide Mortgages |