|

|

|||||

|

||||||

|

|

|

|

|||

|

||||

|

|

Subprime Mortgage Loans Learn How to Buy or Refinance with Bad Credit from the Best Subprime Mortgage LendersAs more people, have seen their fico scores drop our sub-prime lenders have introduced new mortgages for people with poor credit scores, late payments and more. In most cases, people need a "subprime mortgage" when they have lack of equity low credit scores or difficulties documenting their income. For the first time since the program's inception, rates on loans for people with low credit scores have fallen to a never-before seen level for qualified borrowers. And unlike most high-risk lenders, we refer you to companies that do not charge pre-payment penalties when our customers want to refinance. Compare Subprime Mortgage Lender Quotes on Loans for Refinancing or Home Buying People that need a second chance loan will benefit from new opportunities from multiple lenders. Recent reports indicate there has been an immense increase in available credit with expanded subprime loans and private money programs being announced in 2018. Talk to subprime mortgage lenders and compare offers at your convenience. Learn more about sub-prime mortgage loans for refinancing adjustable rates, bill consolidating, lowering monthly payments and cleaning up bad credit. If your credit scores have fallen recently, a subprime loan, 2nd mortgage or HELOC credit loan may be the perfect interim loan until your credit rebounds. There are many subprime mortgage brokers and hard-money lenders offering aggressive, high risk lending programs in the Trump mortgage era. Sometimes waiting for your credit scores to go back up can cost you money. Until your fica scores rise, subprime mortgages can lower your monthly payments by consolidating credit card debt or fixing the rate with your existing adjustable rate loans. Nationwide provides a clear path to shop several subprime loan programs for home buying and refinancing from reputable lenders and subprime mortgage brokers.

The State of Subprime Mortgage Lending Markets in 2018It's no secret that the economy has been all over the map the last 15 to 20 years. With all the U.S. debt and never-ending turmoil in the Middle East, I don't expect that to change. Uncertainty is typically good for mortgage markets because it keeps rates low. Credit typically loosens as default drop and that usually coincides with an improving job market domestically. Since Trump has been elected, we have seen an increase in credit from non-traditional and subprime mortgage lenders across this great nation. We have been informed that credit standards have been eased with specific niche house buying programs from rent to own lenders. With more opportunities for FHA and subprime mortgages we can see a spike in activity for many first-time home buyers in most states. The good news is that some of the private money and non-prime sources have grown impatient waiting and it seems that there are a few groups rolling out new risky mortgage programs for buying and refinancing. Subprime lending options have been opening up from many government and non-prime sources. That means people with credit problems or income documenting issues may see more opportunities to qualify for a subprime mortgage loan.

Find Poor Credit Mortgage Programs It seems that homeowners needing access to money never goes out of style. Today, people continue to refinance for the purpose of obtaining cash, so they can consolidate their debts. That's the most popular use of cash out funds, per the participating subprime mortgage lenders. Especially the consumers stuck with low credit scores or past bankruptcies have been focusing on the subprime loan programs. Did you know you may be able to significantly reduce your current interest rate as well as lower your monthly loan payment so that you can save thousands of dollars each year? We also offer a path to find subprime mortgage lenders that are approved to offer government insured loans. Frequently people that have past credit issues run into speed bumps and pot holes on the road to getting a mortgage approved. We have streamlined the research process, so you only must consider real offers from trusted subprime lenders and brokers. Millions of people have turned to subprime credit options to buy their first home over the last few decades. Rate & Term Refinance on Subprime Loans The rate and term option is simply when a homeowner revises their interest rate or term on their lien without increasing the amount borrowed for cash out or consolidating debt. In some cases, you may be able to borrow up to 100% of the value of your home! FHA approves refinancing to borrowers that typically need a subprime home loan, but the rates are low. Research the new guidelines and credit-score rules for FHA loans. Before committing to a subprime mortgage with a higher interest rate, we suggest researching the government loan programs because the pricing is competitive, and the fees associated are typically nominal. Jumbo Mortgage or Non-Conforming Loans These loans do not conform to the guidelines established by Fannie Mae or Freddie Mac or exceeds the conventional loan limit is called a Jumbo loan. These non-conforming loan amounts can go up to two million dollars. Unless you have good credit and some equity you may need a subprime mortgage company to refinance your jumbo loan. Did you know that we can match you with some of the only non-conforming lenders that provide sub-prime financing to borrowers with low ficos? In a recent report, the HL Wholesale revealed new statistics that many subprime mortgages were actually performing better than in recent years. They indicated that there were less defaults and the delinquency rates had fallen as well. Clearly subprime lending is rebounding, and the housing sector continues to surge. Read more about subprime lenders online. |

|

|

|

|

|

||

|

||

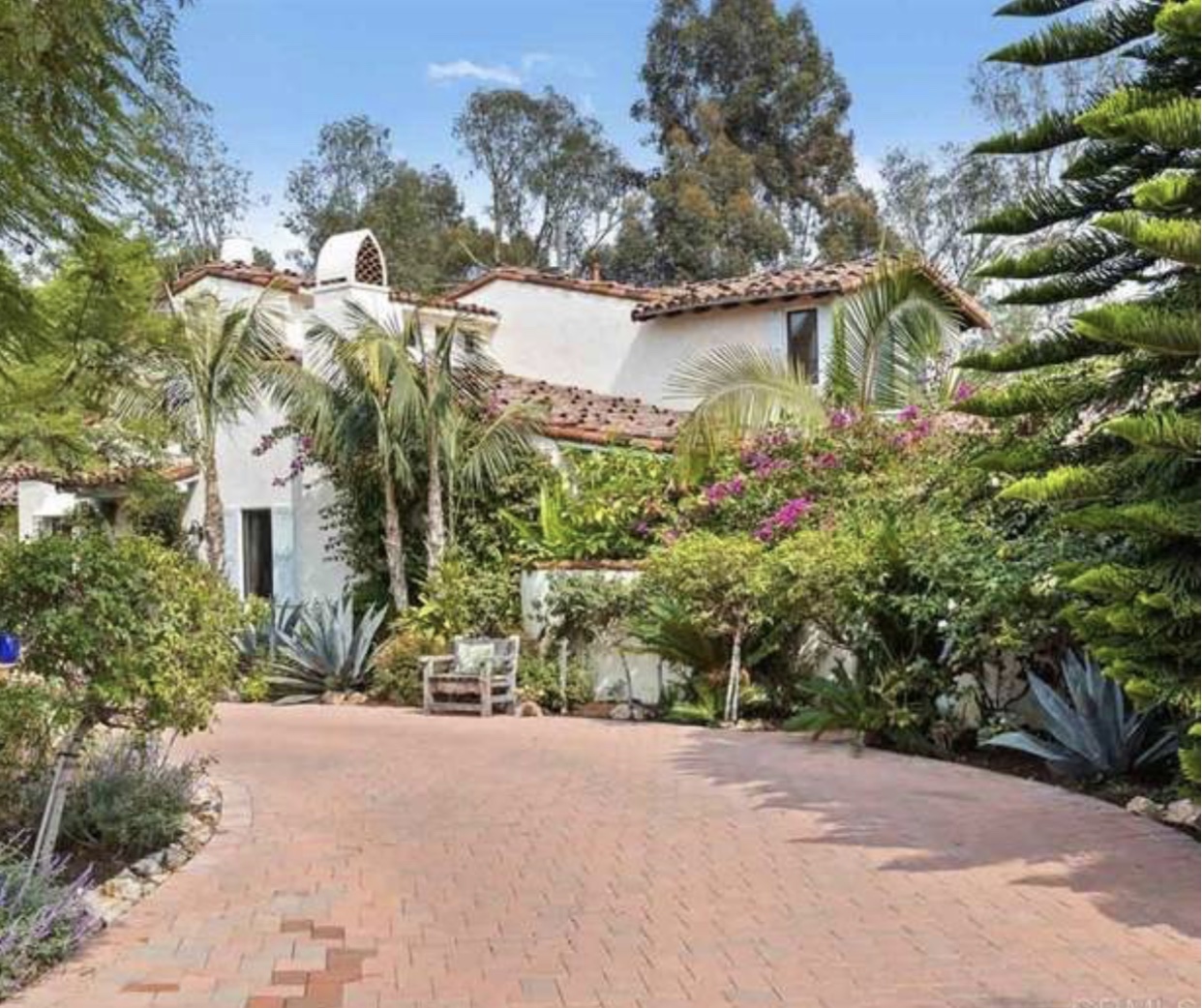

How to Qualify for a First Time Home Loan |

|

Equity Loan for People with Bad Credit |

| How to Get a Mortgage Refinance After a Bankruptcy – Fannie, Freddie and FHA rolled out revised guidelines that offer refinancing 2 years aft a BK

Second Mortgage with Bad Credit |

|

FHA Loans for Buying a House Consider a government loan that enables renters to become homeowners with low payments and flexible options for home purchasing and poor credit refinancing. You may appreciate these flexible subprime mortgages that allow you to buy a house with only a 3.5% down-payment with a FHA loan. |

|

|

|

|

Home | About Us | Warranties and Terms | Articles By clicking "Complete My Request" I am consenting to have my info shared with up to four lenders, brokers, CreditOptions, New American Funding, Global Equity Finance, Loan Depot and other business affiliates and for them to contact you (including through automated means; e.g. autodialing, text and pre-recorded messaging) via telephone, mobile device and/or email, even if your telephone number is currently listed on any state, federal or corporate Do Not Call list. Consent is not required to purchase goods or services from lenders that contact me. Nationwide offers no cost home loan quotes for people seeking refinancing, home equity, purchase mortgages in the United States. Our affiliated lenders will review the credentials of applicants with all types of credit on FHA, VA, Fannie Mae, Freddie Mac and jumbo products. Not everyone will be approved nor can loans be guaranteed online. This website has no affiliation with any government entities. Filling out this form puts you under no obligations. Mortgage rates and home loan programs are subject to change without notice. There is no application fee from participating lenders or banks. This is not an advertisement for credit. This is not a commitment to lend. Certain state restrictions and requirements may apply. ©2000-2019 NationwideMortgages.net - All rights reserved. Nationwide Mortgages |